PEPPOL Requirement from January 1, 2026: Revolution in B2B and Electronic Invoicing

Electronic invoicing is no longer a trend but a necessity. From January 1, 2026, the use of the PEPPOL standard (Pan-European Public Procurement Online) will be mandatory in Belgium.

Tip: Most EU member states are also working on electronic invoicing, but many are currently opting for their own networks managed by the government.

This obligation doesn’t apply only to government entities (for invoices > €3,000). It will now extend to all B2B transactions. Whether you’re an SME, a multinational, or a self-employed professional, you will be required to use PEPPOL for all your commercial transactions.

Tip: PEPPOL is only mandatory within Belgium between VAT-liable entities starting from January 1, 2026. For example, if you’re a doctor, you are not required to use PEPPOL. It’s also not necessary for intra-community invoices or invoices to individuals.

Don’t resist this change, but seize the opportunity to make your processes more efficient and competitive.

Why the PEPPOL Requirement for B2B?

The expansion of this standard to the private sector has a clear goal: harmonization and digitization of economic exchanges in Europe.

PEPPOL, as a standardized network for electronic invoicing, simplifies commercial transactions and ensures compliance with applicable regulations. Its widespread adoption aims to achieve several key objectives:

- Simplification of Processes: PEPPOL enables invoices to be sent and received in a standardized and automated manner, regardless of the business partner. No more hassle with different formats and systems.

- Security and Traceability: Through a secure network, PEPPOL guarantees the authenticity and integrity of invoices, providing full traceability.

- Cost Savings: Automating invoicing significantly reduces administrative costs, processing times, and human errors. This leads to improved cash flow and smoother business relationships.

- Compliance and Transparency: Implementing PEPPOL ensures that your business complies with new legal obligations in Belgium and Europe, while also facilitating audits and inspections.

PEPPOL: The B2B Requirement for Everyone

Starting from January 1, 2026, every Belgian company will be required to use PEPPOL to exchange invoices with its business partners. This means that all your B2B interactions—whether for product sales or services—must take place through this secure network.

How PEPPOL Revolutionizes Your B2B Exchanges

- Faster Transactions:

PEPPOL standardizes processes and ensures quick invoice processing. Imagine a future without payment delays and misunderstandings about invoices. By automating and standardizing your exchanges, you boost productivity. - Reduction of Fraud Risks:

Invoice fraud is a major issue for many businesses. PEPPOL, as a secure and interoperable network, protects your transactions from falsifications and errors. Exchanging through secure channels ensures increased protection of your sensitive data. - Increased Competitiveness:

Companies that switch early to PEPPOL invoicing can better respond to new market demands and their business partners. In 2026, non-compliance could lead to exclusion from important collaborations or even tenders. Use this transition to modernize your processes, improve payment terms, and offer your partners an optimal experience.

With Accowin, You’re Ready for the PEPPOL Requirement

Getting ahead of the PEPPOL mandate is crucial for ensuring a smooth transition. Here are the key steps to be ready for 2026:

- Evaluate Your Invoicing System:

Check if your current tools are compatible with PEPPOL. If not, consider updating or migrating to a compatible solution.

✅ Accowin is already PEPPOL-compatible and uses standard UBL formats. The transition to the PEPPOL BIS 3 format will therefore be smooth and natural. - Choose a PEPPOL Provider:

Work with a certified Access Point provider to help implement electronic invoicing. These providers automate your processes and ensure full compliance.

✅ Accowin and its technological partner offer you an access point that complies with the latest standards. - Train Your Teams:

Ensure that your employees understand the benefits of PEPPOL and are ready to use the new tools.

✅ Accowin allows you to maintain your current working environment while opening new possibilities. - Prepare for Expansion to the Private Sector:

If you already work with government agencies, you may be familiar with PEPPOL. However, starting in 2026, this standard will expand to all sectors. Be ready to use it for all your B2B exchanges, regardless of the partner.

✅ Accowin was one of the first accounting software solutions to offer the UBL invoicing format. The evolution to PEPPOL will be smooth and natural.

PEPPOL: A Springboard for the Future of Your Business

The PEPPOL requirement starting on January 1, 2026, marks a turning point in the management of financial and commercial flows in Belgium and Europe. By adopting it now, you get ahead of your competitors, modernize your workflows, and ensure compliance for your business. Don’t let this transformation pass you by. Anticipate, prepare, and optimize to fully benefit from PEPPOL in your B2B exchanges.

The revolution in B2B invoicing is underway—be ready to take part.

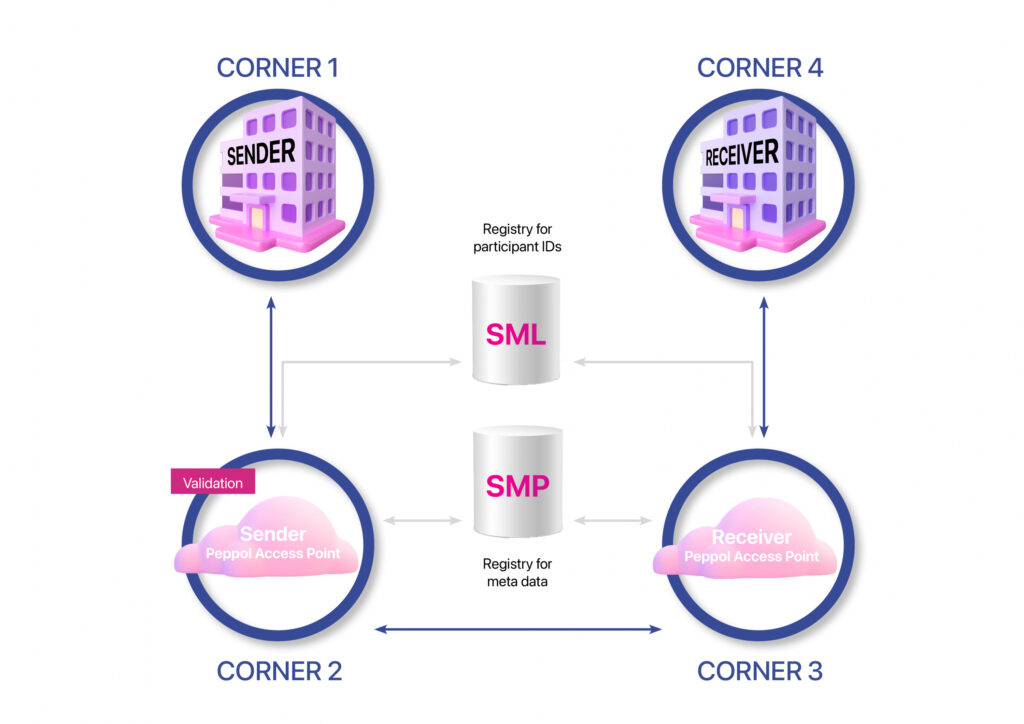

Do you have general or specific questions about PEPPOL’s architecture and flows?

Let us know: info@lbrp.be